The Census Bureau's fourth-quarter earnings survey is out, and the news is generally good. The median American was taking home $41,392 at the end of last year, up 1.7% from last year and slightly outpacing inflation.

美国人口普查局的第四季度收入调查结果出来了,总体来说是好消息。去年美国人年收入的中位数是41392美元(译者注:按3月2日汇率合259611元人民币),比上一年涨1.7个百分点,并且略微跑赢了通胀。

But that headline number alone doesn't really tell the whole story. As you might expect, the data gets much more interesting when you start investigating certain variables, like one's age and sex.

但是这个中位数代表不了所有人。正如你想的那样,当你开始按照一定的变量,比如分年龄和性别来统计,数据就变的更加有趣了。

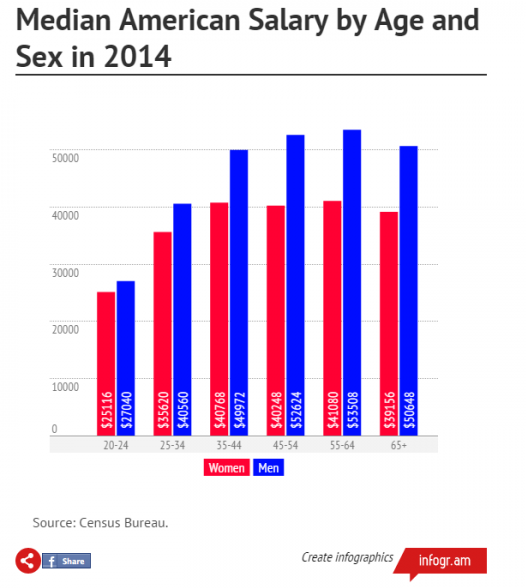

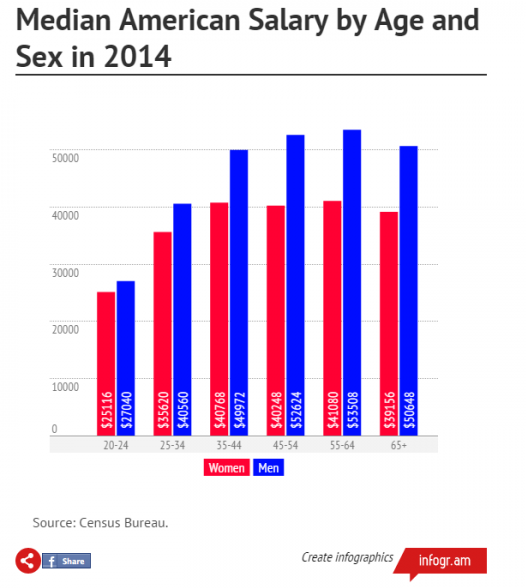

To get a better idea of how you compare to your peers, check out the graph below, which breaks down earnings by specific age groups for both men and women.

为了更好的让你了解到相比同辈们你的收入到底如何,看下面这张表。按年龄段分析男性女性。

There are two huge and important takeaways from this data: younger workers earn less, and women earn less. Let's go over what each group can do to neutralize this comparative disadvantage and still achieve financial independence.

这个数据透露出两个重量级的信息:越年轻的就业者赚的更少,女性就业者赚的更少。让我们看看这两个人群该做些什么来消除这种比较劣势并获得财务自由。

Younger workers still have one big advantage

年轻的就业者仍然有一大优势

It's makes sense that the more experience you have in your field, the higher your salary will be. No one should be too surprised to see the typical 24-year-old earning about 45% less than her 55-year-old colleagues.

你在一个领域里面经验越多,你的薪资越高,这符合常理。没人会对24岁的人比她/他55岁的同事赚的少45%而感到惊讶。

But there's a terrible irony to the situation in general: Money saved and invested when you're 24 will be worth a lot more upon your retirement than money put away when you're 55. That's because it will have three more decades to compound.

但是很具讽刺意味的是:你从24岁开始存钱和投资,到退休时,你的钱会比你从55岁开始,要多的多。因为这样你会多30年的积累。

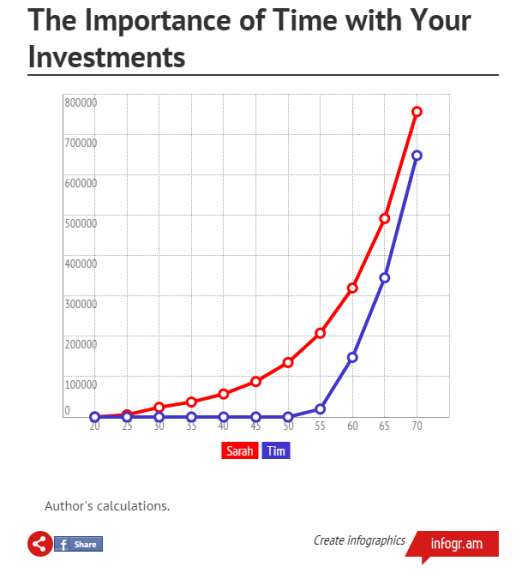

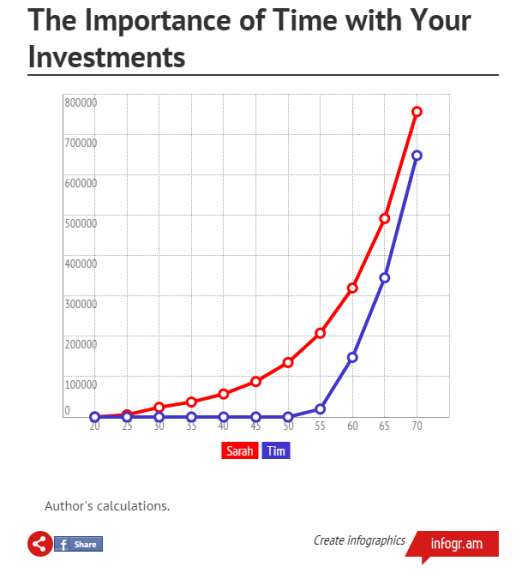

To get an idea for what I'm talking about, let's consider two scenarios. In our first, we have Sarah -- a hard-working, 24-year-old who somehow manages to put away $200 per month, every month, until the age of 30. After that, she is no longer able to save, as the additional costs of raising a family and now only working part-time take a financial toll.

为了让你体会到我说的是什么,我们设想两个场景。第一个,莎拉,24岁,工作勤奋,每个月能存200美元,一直到30岁。在这之后,她存不了钱了,因为家庭开支增加、并且只能做一些兼职工作(译者注:潜台词是组建家庭养育小孩之类)造成的负面影响。

Our second subject is Tim, who didn't pay much attention to saving for retirement until he hit age 55. He has had above-average earnings his whole career, but usually spent all of that money in short order. Now that he's 55, he gets serious and starts putting away a whopping $1,500 per month -- far more than Sarah did, even after inflation.

第二个,蒂姆,一开始并不太注意为了退休而储蓄,直到他55岁。他的整个职业生涯收入都高于平均水平,但是赚的钱通常很快就花掉了。现在他55岁,开始认真起来开始每个月存1500美元——远比Sarah高,甚至把通胀考虑进来也是如此。

Assuming both of them earn the S&P 500's historical return of about 9%, who will have more money when they hit 70? This leaves us with one hard and fast conclusion: Be extra mindful of your spending and saving during your early working years. Sarah only saved for seven years, but it ended up making a huge difference in the long run. If nothing else, make sure you do everything you can to get your maximum employer match in your 401(k) or 403(b) plan -- if it is offered to you.

这让我们得出一个结论:要特别注意你的花销,并且一旦工作要尽早开始储蓄。莎拉只存了7年钱,但是结果却赢了这场长跑。如果有可能,你应该尽量选择金额最高的退休金计划。

Females earn less, but save and invest more... most of the time.

女性赚的相对少,但是大多数情况下女性储蓄和投资更多。

By the end of 2014, the median female worker was earning $37,596, while her male counterpart was pulling in $45,500. But there's a crazy irony here as well: Most working women have more in savings than men.

2014年底,女性就业者平均年收入是37596美元,而男性则有45500美元。但是,寒,大多数女性就业者比男性存款更多。

That's because women participate in workplace savings programs at higher rates than men and save more of their salaries than men. For instance, 79% of women earning between $50,000 and $75,000 per year participate in such programs -- versus 60% for men -- and sock away an average of 7.2% of their salary -- versus 6.7% for men. The same general pattern holds true across all income levels, according to Vanguard.

这是因为女性比男性更多参加社保,并且把工资的更大部分用于储蓄。例如,年收入在5万美元至7.5万美元之间的女性有79%参加社保,而男性只有60%——并且女性平均把收入的7.2%存起来,而男性只有6.7%。根据Vanguard报道,在所有的收入阶层都是如此。

In fact, for all income levels except those over $100,000 per year, the median female has more saved than the median male. That's an impressive feat to say the least. And the most obvious explanation for the difference among the highest earners is that men rarely take time off of work to help raise families -- which means that they get the promotions that accompany such high salaries earlier in their careers. That gives their investments more time to compound.

事实上,除了年收入高于10万美元的以外,在所有其他收入阶层,女性的平均存款都高于男性,绝对令人刮目相看。至于最高收入阶层之所以不同,对此最明显的解释是男性很少花时间来照顾家庭,这意味着他们更早获得提升并获得高收入。这使得他们的投资有更多的时间来积累回报。

What you save now matters

你现在能储蓄什么很关键

In the end, what you are able to save -- and invest -- right now will make a huge difference in how prepared you are for retirement.

归根结底,你现在能存或者投资什么,将会给你退休以后的生活带来巨大不同。

If you are younger, save and invest whatever you have. You have a crucial advantage on your side: time.

如果你很年轻,尽可能的存钱和投资。你有一个至关重要的优势:时间。

And if you are a woman, keep up the impressive saving and investing habits. If you're a high earner who wants to keep pace with your male counterparts, consider taking a more aggressive investing approach.

如果你是女性,保持你令人印象深刻的储蓄和投资的习惯。如果你是一个高收入者,想和你的男性同行比肩,那就做一个进取型的投资者。

And if you're behind on your retirement savings -- man or woman, young or old -- we might have found just thing to help.

如果你欠缴养老金——不论男女老少——我们可能知道你该如何做。

The $60K Social Security bonus most retirees completely overlook

大多数退休者完全忽视掉了的6万美金社保津贴

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could ensure a boost in your retirement income of as much as $60,000. In fact, one MarketWatch reporter argues that if more Americans used them, the government would have to shell out an extra $10 billion… every year! And once you learn how to take advantage of these loopholes, you could retire confidently with the peace of mind we're all after. Simply click here to receive your free copy of our new report that details how you can take advantage of these strategies.

如果你与大多数美国人一样,你可能欠缴几年(甚至更多)退休金。但是一些少有人知的"社保秘密"会帮助你使你的退休金增加6万美元。事实上,MarketWatch一名记者曾表明如果更多美国人都使用这条,政府将被迫多支出100亿美元...每年!一旦你学到如何占这些漏洞的便宜,你就能像我们一直追求的那样心平气和的自信退休。点击这里可以收到详细资料......