Global investors have been in thrall to the central banks ever since quantitative easing (QE) started in 2009 and, of course, all eyes are on the Federal Reserve this week. The Fed has now frozen its QE programme, and may raise rates sometime this year, though perhaps not as early as next Thursday. Nevertheless, global investors have been comforted by the extremely large increases in balance sheets proposed by the Bank of Japan (BoJ) and the ECB, and the overall scale of worldwide QE has seemed likely to remain sizeable for the foreseeable future.

自从2009年“量化宽松”启动以来,全球投资者一直受制于央行,当然,本周所有的目光将聚焦于美联储(Fed)。美联储现在已冻结其量化宽松政策,并可能在今年某个时间加息(但或许不会在本周四就加息)。不过,日本央行(Bank of Japan)和欧洲央行(ECB)打算大规模扩张资产负债表的计划曾让全球投资者感到宽慰,在可预见的未来,全球量化宽松的整体规模原本似乎仍将十分可观。

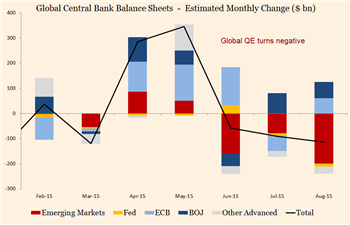

However, in recent months, an ominous new factor has arisen. Capital outflows from the emerging market economies (EMs) have surged, and have resulted in large declines in foreign exchange reserves as EM central banks have intervened to support their exchange rates.

然而,最近几个月,一个不祥的新因素出现了。新兴市场的资本流出激增,并导致外汇储备大幅下降,原因是新兴市场央行采取干预措施,以支撑本币汇率。

Since these reserves are typically held in government bonds in the developed market economies (DMs), this process has resulted in bond sales by EM central banks. In August, this new factor has more than offset the entire QE undertaken by the ECB and the BoJ, leaving global QE substantially in negative territory.

由于这些外汇储备通常以发达经济体的政府债券的形式持有,因此这一过程导致新兴市场央行抛售发达经济体债券。今年8月,这个新因素不仅仅抵消了欧洲央行和日本央行采取的全部量化宽松举措,还让全球量化宽松出现很大的负值。

Some commentators have become concerned that this new form of “quantitative tightening” will result in a significant reversal of total central bank support for global asset prices, especially if the EM crisis gets worse. This blog examines the quantities involved, and discusses the analytical debate about whether any of this matters at all for asset prices.

一些评论人士开始担心,这种新形式的“量化紧缩”将导致央行对全球资产价格的支持出现大逆转,特别是如果新兴市场危机加剧的话。这篇博文分析了相关的数值,并试图评述各方探讨这些数值对资产价格是否重要的辩论。

The conclusion is that the EM factor is likely to offset part, but perhaps not quite all, of the QE planned by the ECB and the BoJ in the next year. Overall, global QE will provide much less stimulus than it has since 2006.

结论是,新兴市场因素可能会在一定程度上抵消——但或许不会全部抵消——欧洲央行和日本央行明年计划推出的量化宽松计划。总的来说,全球量化宽松政策带来的刺激将远远小于2006年以来的水平。

The major sources of central bank balance sheet expansion at present are of course the bond purchase programmes announced by the BoJ and the ECB. Together these programmes are running at an average of about $130 billion a month. The average maturity of the bonds purchased is probably around 7 years, so an enormous amount of “bond duration” is still being removed from private sector hands in the developed economies.

目前,央行资产负债表扩张的主要原因是日本央行和欧洲央行的债券购买计划。它们的规模加起来达到平均每月1300亿美元左右。央行购买的债券的平均期限大概在7年左右,因此在发达经济体,数量庞大的“债券期限”仍在从私营部门投资者手中移出。

The question is how much of this stimulus is likely to be offset by the sale of EM bond holdings as a result of the foreign exchange intervention by EM central banks. Fulcrum estimates that total EM central bank balance sheets may have declined by about $450 billion in the 3 months since the crisis worsened in the summer, of which about $170 billion has come from China alone.

问题是,新兴市场央行干预汇市引发的债券抛售,可能会在多大程度上抵消这种刺激效应。Fulcrum估计,在此次危机于今年夏季加剧以来的3个月里,新兴市场央行的资产负债表总规模可能已缩减4500亿美元左右,其中仅中国就缩减了约1700亿美元。

Consequently, global QE, measured by this metric, has probably turned substantially negative [1]. Nomura (and others) estimate that foreign exchange intervention by the EMs was probably around $160 billion in August alone, and this would have directly triggered bond sales in the US and Europe.

因此,以这个指标衡量,全球量化宽松可能已转变为一个相当大的负值[1]。野村(Nomura)(以及其他机构)估计,单单今年8月,新兴市场的外汇干预力度就可能高达1600亿美元,这应该会在美国和欧洲直接引发债券抛售。

Of course, no-one can prove that this drain of central bank liquidity caused the rise in global bond yields and the drop in risk assets last month; market interpretations of Fed policy have probably been just as important. Nevertheless, it is an interesting fact that has grabbed the attention of macro investors. The release of China’s foreign exchange reserve figures has suddenly become one of the most watched global data releases each month.

当然,没有人能证明,央行流动性的减少导致上月全球债券收益率上升和风险资产下跌;市场对于美联储政策的解读可能同样重要。不过,这个有趣的情况吸引了宏观投资者的目光。中国的外汇储备数据突然变成最受关注的全球月度数据之一。

What is the outlook for this measure of global liquidity over the next year or so? The BoJ and the ECB are, if anything, considering further extensions of their bond purchase programmes. Consequently, global QE will return to positive territory unless the large drain on EM foreign exchange reserves continues.

未来一年左右,这一衡量全球流动性的指标会如何变化?日本央行和欧洲央行或许正考虑进一步扩大债券购买计划。因此,除非新兴市场的外汇储备继续大规模减少,否则全球量化宽松将恢复正值,

But this drain is likely to be maintained for a while. A recent detailed analysis of global reserve holdings by Deutsche Bank economists [2] suggests that total global reserves could fall by $1,500 billion during the current drawdown, about a third of which has already happened. This might take EM central bank balance sheets roughly back to where they were just before the 2008 financial crash as a share of EM GDP – a pessimistic but not extreme outcome.

但这种流动性减少可能会保持一段时间。最近德意志银行(Deutsche Bank)的经济学家对全球外汇储备的一份内容详实的分析[2]表明,在本轮外汇储备下降趋势中,全球外汇储备总额可能会减少1.5万亿美元,到目前已经减少了其中的约三分之一。这可能会让新兴市场央行的资产负债表占新兴市场GDP的比例,大致回到2008年全球金融危机爆发以前的水平,这是一个悲观的结果,但并不是十分严重。

On this and other assumptions, Fulcrum estimates that the total increase in global central bank balance sheets as a percentage of world GDP, which is one indicator of the stimulus from global QE, would be fairly close to zero next year, compared to an average injection of about 2 per cent of global GDP in recent years. Apart from a short period at the end of 2009, this would be the lowest rate of expansion since 2006:

根据这种或其他假设,Fulcrum估计,全球央行资产负债表扩大的规模占全球GDP的比例(这个指标衡量全球量化宽松政策所带来的经济刺激)将在明年非常接近零——最近几年平均为2%左右。除了2009年底很短的一段时间以外,这将是自2006年以来全球央行资产负债表最慢的扩张速度。

There is huge uncertainty here. If China and other EMs stop intervening in the foreign exchange markets, then the drain on reserves and on global liquidity would soon end as EM exchange rates fall towards their equilibrium levels. Alternatively, private sector EM capital outflows might end spontaneously, as they did after the “taper tantrum” in 2013. But the deterioration in economic fundamentals in the EMs looks more serious than in 2013, so the current shock could be long lasting.

这里存在巨大的不确定性。如果中国和其他新兴市场不再干预外汇市场,那么随着新兴市场汇率跌向均衡水平,外汇储备和全球流动性的下滑将很快结束。或者,新兴市场的私人部门资本外流可能自动结束,就像2013年的“削减恐慌”(taper tantrum)之后的情况一样。但新兴市场经济基本面的恶化看起来比2013年更为严重,因此当前的冲击可能相当持久。

What then? Some economists, like Matthew Klein at FT Alphaville, and Paul Krugman, argue that sales of bond holdings by foreign central banks do not matter anyway. Krugman argues that they hold bonds of very short maturity, which are close to cash, and he points out that sales of these bonds can always be easily offset by Fed action to hold short rates down. But the average maturity of US bond holdings by foreign central banks, at 3.95 years, is not negligible. Furthermore, since the Fed is thinking about raising rates, it may not want to offset the impact of foreign bond sales on US medium dated bond yields.

接下来会出现什么情况?一些经济学家——比如英国《金融时报》旗下FT Alphaville的马修凯文(Matthew Klein),保罗克鲁格曼(Paul Krugman)——认为,外国央行抛售政府债券的行为并不重要。克鲁格曼认为,他们持有的债券的期限非常短,这近似于现金。他指出,这些债券的抛售始终可以被美联储维持短期利率处于低水平的举措抵消。但是,外国央行持有的美国国债的平均期限是3.95年,这并非不重要。此外,既然美联储正考虑加息,它可能不想要抵消外国债券抛售对美国中期债券收益率的影响。

In my opinion, one of the few analytical lapses made by the Keynesian camp after 2010 has been a reluctance to believe that QE – or bond buying by foreign central banks – could impact asset prices and economic activity, except through a signalling effect about the future path of Fed short rates. Yet studies by the Fed [3] and the ECB [4] suggest that these bond purchasing programmes have had important effects on yields through “portfolio balance” effects, as private investors are induced to extend bond duration and hold riskier assets.

在我看来,凯恩斯学派在2010年之后的分析中犯下的错误之一是,他们不愿相信量化宽松(或者外国央行的债券购买行为)可能影响资产价格和经济活动,除了释放出关于美联储短期利率未来路径的信号以外。然而美联储[3]和欧洲央行[4]的研究表明,由于“资产组合平衡”(portfolio balance)效应,这些债券购买项目对收益率有重大影响,因为私人投资者被诱使延长债券期限,并持有风险更高的资产。

Surely, the same could now happen in reverse when EM central banks trim their bond holdings. If so, the EM reserve drain is another item to add to investors’ long list of concerns at the moment.

当然,当新兴市场央行削减他们持有的债券时可能会发生相反的情况。若果真如此,新兴市场外汇储备减少将在投资者长长的焦虑清单上又添上一笔。