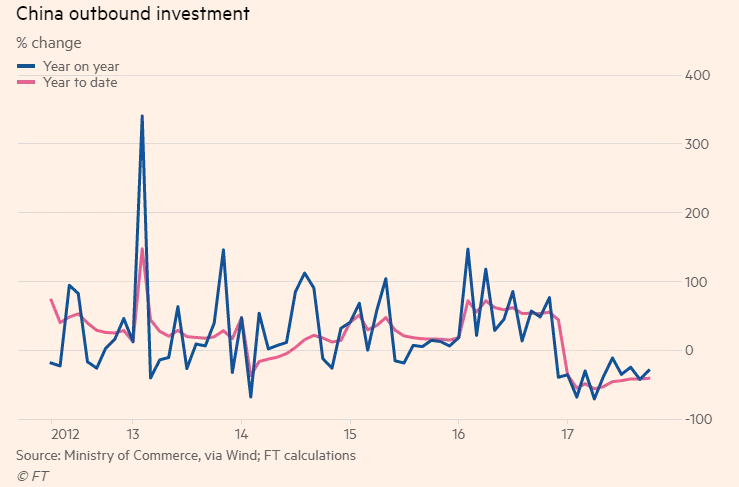

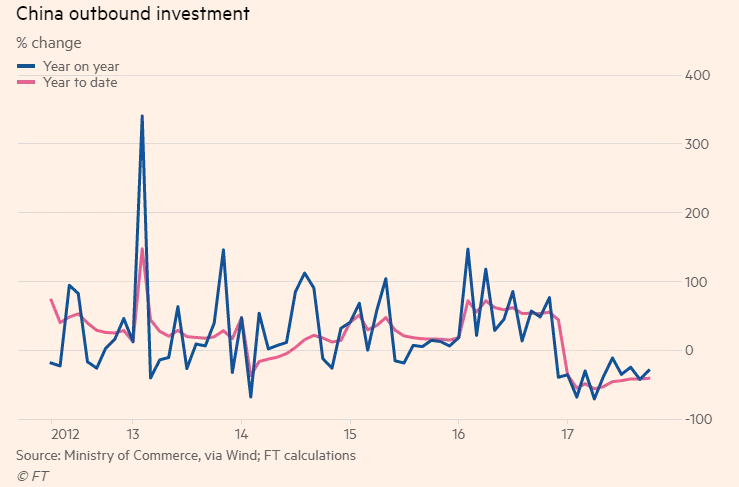

China’s outbound non-financial investment fell 40.9 per cent during the ten months through October, according to official figures, reflecting the enduring impact of strict capital controls.

根据官方数据显示,今年前10个月中国对外非金融类投资同比下降40.9%,这反映出中国政府严格的资本管控带来持续影响。

Outbound investment for the period totalled $86.3bn, according to the Ministry of Commerce.

中国商务部(Ministry of Commerce)表示,今年1-10月中国对外投资总计863亿美元。

That put outbound investment for October at $8.3bn, according to FT calculations based on official data, for a year-on-year fall of 26.5 per cent.

英国《金融时报》根据此前的官方数据计算得出,这意味着10月中国对外投资额为83亿美元,同比下滑26.5%。

Regulators clamped down on outbound deals following an unprecedented flood of offshore acquisitions in 2016 that drained China’s foreign exchange reserves. In August this year, China’s cabinet formalised a new framework that encourages deals that fit Beijing’s strategic priorities and discourages deals in entertainment, sports and luxury real estate

2016年空前的海外收购潮消耗了中国大量外汇储备,随后监管部门开始严格限制境外交易。今年8月,中国政府出台了新框架,鼓励那些符合北京战略重点的交易,并限制涉及娱乐、体育和豪宅等方面的交易。

In early November the government further tightened controls over outbound investment by requiring regulatory approval for some foreign acquisitions conducted through an offshore entity.

11月初,中国政府要求一些通过离岸实体操作的境外收购需得到监管部门批准,进一步收紧了对境外投资的管控。