Emerging Asia’s biggest noodle producers are competing to spice up the humble packet of instant noodles in an attempt to boost revenues as sales of low-end, everyday noodles stagnate.

随着低端方便面销售陷入停滞,亚洲新兴经济体的各大方便面生产商正竞相让不起眼的方便面走高档化路线,以求提振营收。

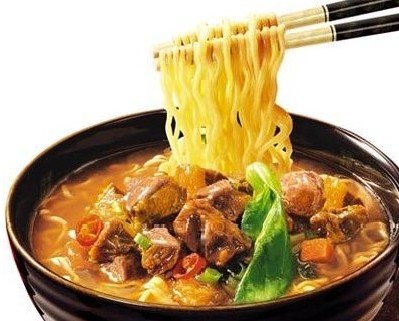

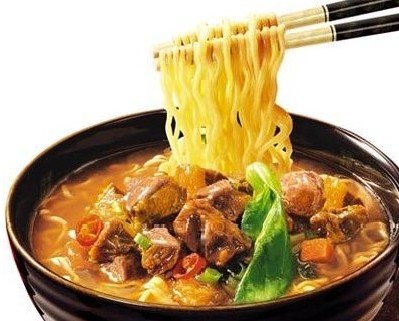

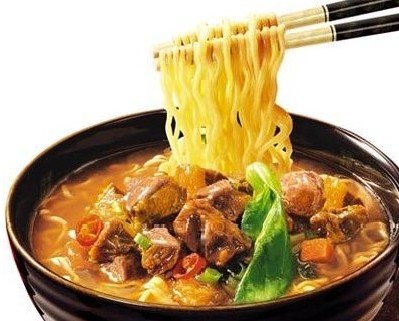

High in energy, low in nutrition and selling for as little as $0.10, easy-to-cook instant noodles have become a staple food for more than 1bn people across Asia and a cash cow for companies such as Tingyi, Uni-President and Indofood, which dominate the $33bn market.

方便面热量高,营养低,烹制容易,售价可低至0.1美元,已成为亚洲逾10亿人口的主食,也是康师傅(Tingyi)、统一企业(Uni-President)、印多福(Indofood)等公司的摇钱树,这三家主宰着这个330亿美元的市场。

In pushing their customers to trade up to more expensive and profitable types of noodles, these companies are following in the footsteps of global consumer goods companies such as Unilever and Nestlé, which have deployed this “premiumisation” strategy on everything from shampoo to ice cream.

这些方便面公司正推动消费者购买价格更贵、利润更高的方便面,从而踏上了联合利华(Unilever)、雀巢(Nestlé)等全球消费品企业的后尘,这两家公司已在从洗发精到冰淇淋的种种产品上实施了这种“高端化”(premiumisation)策略。

Last year, for example, Unilever bought T2, an Australian premium tea business to complement its mass market Lipton teas. It has been selling underperforming brands that have mainly been in relatively unhealthy food categories, such as Skippy peanut butter, Wish-Bone dressings and its Peperami salami snack.

比如,联合利华去年收购了澳大利亚高端茶叶零售商T2,以补充旗下大众市场茶叶品牌立顿(Lipton)。该公司出售了几个效益不佳的品牌,基本上都是相对不健康的食品,如四季宝(Skippy)花生酱,Wish-Bone沙拉酱和Peperami零食香肠。

Having launched joint ventures with the likes of Japan’s Asahi and local Pepsi bottlers, Asia’s noodle makers are branching out into more lucrative soft drinks and snacks, capitalising on the unrivalled distribution networks they have built in China and Indonesia, the world's first- and fourth-most populous countries.

亚洲方便面生产商已与日本的朝日(Asahi)及当地百事(Pepsi)瓶装公司成立合资企业,涉足利润更高的软饮料和零食领域,并充分利用他们在中国和印尼建立起来的无可比拟的分销网。中国和印尼分别为世界第一和第四人口大国。

Over the past two decades, the instant noodle revolution in Asia helped make the Taiwanese founders of Tingyi and Uni-President, and the family behind Indonesia’s Indofood, wealthy tycoons. The four Wei brothers who built Tingyi are the third-richest family in Taiwan, according to Forbes.

过去20年期间,亚洲的方便面革命帮助康师傅和统一的台湾创始人,以及印尼印多福背后的家族成为富商巨贾。根据《福布斯》(Forbes)的资料,创立康师傅的魏氏四兄弟是台湾第三富家族。

Indonesia’s Salim family, which built Indofood after obtaining a monopoly licence to mill flour under the Suharto dictatorship, controls large parts of the economy from car distribution to the local KFC franchise.

印尼三林家族(Salim)控制着从汽车销售到当地肯德基(KFC)特许经营权的相当大一部分经济。该家族在苏哈托(Suharto)独裁时期取得垄断的磨面许可,由此打造起印多福公司。

But with the markets for cheap noodles saturated in China and Indonesia, the two biggest consumers of instant noodles, these companies are racing to produce higher-value products, from more exotic flavours to more convenient cup noodles that can be eaten straight out of their packaging.

但随着中国和印尼这两个最大的方便面消费国的平价方便面市场逐渐饱和,这些公司开始竞相生产价值更高的产品,从比较异国风味的产品,到可以直接在包装里吃的更方便的杯面。

In addition, noodle makers face the rising costs of wheat and other raw materials, and a shift by Asia’s emerging middle class away from snack foods toward healthier options, an established trend in the US and Europe.

此外,方便面生产商还面临着小麦及其他原材料成本上涨,以及亚洲新兴中产阶层舍弃快餐食品,转向更健康饮食的挑战,后者在美国和欧洲早已形成趋势。

“Indonesians eat more noodles per capita than any other country apart from South Korea, so I don't think they can eat that many more noodles,” says Erwan Teguh, head of research at CIMB in Jakarta. “As volume growth slows, it’s all about pushing value growth and getting people to trade up.”

“印尼人的人均方便面食用量仅次于韩国,所以我不认为他们还能大幅增加自己的面条食用量。”雅加达联昌国际(CIMB)的研究部主任Erwan Teguh说,“随着销量增长放缓,能做的就只有推动价值增长,推动人们购买高档产品。”

Annual per capita consumption of noodles in Indonesia rose by an average of 5.2 per cent from 2001, to reach 66 packets a year in 2007. Since then it has declined 1.5 per cent a year to 61 packets last year, according to Malaysia’s Maybank.

根据马来西亚马来亚银行(Maybank)的数据,印尼人均方便面消费量从2001年起以年均5.2%的增速上涨,至2007年达到人均66包。2007年以后又以每年1.5%的速度下降,到去年降至人均61包。

About 43 per cent of Indonesia’s 250m people live on less than $2 a day, and many eat instant noodles several times daily.

印尼2.5亿人口中,大约43%的人每日生活费低于2美元,许多人一天吃好几顿方便面。

Similarly, sales growth in China slowed from 12 per cent in 2012 to 3 per cent in 2013, according to Bernstein. But in China, where consumption per capita is roughly half that of Indonesia, the culprit is primarily demographics.

根据伯恩斯坦(Bernstein)的数据,中国的方便面销售增长同样在下降,从2012年的12%降至2013年的3%。但在人均消费量大致仅为印尼一半的中国,增长放缓的主因在于人口结构。

Analysts at Citi say the rates of growth in migrant worker and student populations in China have been shrinking in recent years – bad news for noodle makers as these groups are large consumers of such convenience foods.

花旗(Citi)分析师表示,中国的外来务工人员和学生人数增长率近年有所下降,这对方便面生产商来说是坏消息,因为这两大群体是方便食品的消费主力。

As market conditions have shifted, companies have been forced to compete on price and product innovation, squeezing profit margins.

随着市场环境发生变化,各公司被迫在价格和产品创新方面展开竞争,利润率受到挤压。

Tingyi, which has more than 50 per cent market share by value in China, saw its gross margins for noodles slip from 30 to 29 per cent in 2013. Uni-President, a distant second with 17 per cent of the market, has had to cut prices more deeply to stay competitive and its gross margin fell from 33 per cent to 2 per cent in the same period.

在中国占据逾50%市场份额的康师傅,2013年毛利润率从30%下滑至29%。市场占有率为17%、遥居第二的统一不得不以更大幅度降价以保持竞争力,同期毛利润率从33%跌至2%。

Charles Yan, head of China consumer research at Standard Chartered in Hong Kong, says that while these companies are unlikely to continue increasing sales volumes, they have ample room to sell more expensive noodles as the Chinese economy continues to grow rapidly.

香港渣打银行(Standard Chartered)大中华区消费品研究主管严志雄(Charles Yan)表示,虽然这些公司不太可能保持销量持续增长,但随着中国经济继续快速增长,他们有销售较高价方便面的大量空间。

He points out that Chinese consumers in wealthier Hong Kong and Taiwan fork out roughly double the amount spent on noodles each year by their counterparts in China and Indonesia.

他指出,在更为富裕的香港和台湾,消费者每年在方便面上的支出大致是中国和印尼消费者的两倍。

Indomie, Indofood’s best-known brand, recently launched a Taste of Asia range that includes Thai Tom Yam and Korean Bulgogi flavours and sells for about Rp4,000 ($0.35) per packet, more than double the price of its typical Indonesian options.

印多福旗下知名品牌营多面(Indomie)最近推出了“亚洲味道”(Taste of Asia)系列,包括“泰国冬荫”(Tom Yam,也称:泰式酸辣汤)及“韩国烤肉”(Bulgogi),每包售价约为4000卢比(0.35美元),是其印尼市场典型产品售价的两倍多。

Producers in Indonesia and China are pushing cup noodles, which sell for three to four times as much as a regular packet. Analysts say sales of cup noodles are growing at double-digit rates because of demand from time-poor, city dwellers.

印度尼西亚和中国的生产商正推动杯面的销售,其售价为普通袋装面的三到四倍。分析师表示,得益于时间宝贵的城市居民的需求,杯面销量正以两位数的速率增长。

“It’s all about convenience,” says Mr Teguh. “Rather than putting the noodles in a pan and cooking them, they just put hot water in a cup.”

“关键是方便。”Teguh说,“杯面不用将面条放到锅里煮,只要往杯子里加热水就行了。”

Typically, noodles are bought in small single-serving plastic packets of 80g and boiled in a pan for about two minutes.

市场上出售的袋装面一般装在每份一包(80克)的塑料包装袋里,需在锅中煮2分钟左右。

Sales of noodles with reduced salt and fat content are picking up sharply, albeit from a low base, as an increasing number of middle class consumers adopt healthier lifestyles.

随着越来越多的中产阶层消费者倾向更健康的生活方式,减盐、减脂的方便面销量正急速提升,尽管基数较低。

Despite the challenges they face, Asia's biggest noodle producers are well placed to tap changing consumer tastes, having built vast distribution networks that stretch to remote villages in large countries with poor infrastructure, and are expanding aggressively into more lucrative segments.

虽然面对着种种挑战,但亚洲各大方便面生产商在利用消费者的口味变化方面处于有利地位,因为他们已经建立庞大的分销网络,即使在那些基础设施贫乏的大国也延伸至偏远乡村,而且他们正向利润更高的品类积极扩张。

“Indofood is using noodles as a way to get cash flow now; they are not really trying to expand margins,” says Mr Teguh of CIMB. “The more lucrative growth will come from non-noodle businesses like beverages, dairy and restaurants.”

“印多福现在利用方便面作为获取现金流的渠道,他们并不真想提高利润率。”联昌国际的Teguh说,“更有利可图的增长将来自饮料、奶制品和餐馆等方便面以外的业务部门。”