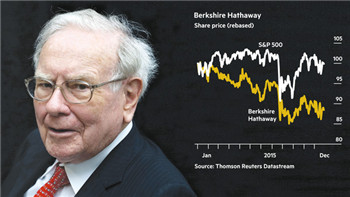

Investment guru Warren Buffett is heading for his worst year relative to the rest of the US stock market since 2009, with shares in his conglomerate Berkshire Hathaway down 11.5 per cent with two more trading days to go.

投资大师沃伦巴菲特(Warren Buffett)即将告别自2009年以来他相对于美国股市大盘表现最糟糕的一年,今年只剩下两个交易日之际,他旗下的企业集团伯克希尔哈撒韦公司(Berkshire Hathaway)今年股价下跌11.5%。

The underperformance comes in Mr Buffett’s golden anniversary year at the helm, when he told investors for the first time that they should judge his record on Berkshire’s share price, rather than just the book value of the company — his preferred yardstick for decades.

此次跑输大盘正值巴菲特掌舵的黄金周年,当年他首次告诉投资者,他们应当根据伯克希尔的股价(而不只是该公司的账面价值)来评判他的投资记录,这也是他持续几十年的首选尺度。

Mr Buffett urged them to make that judgment based on the long term, rather than on a single year, reflecting investor Benjamin Graham’s view that the stock market may be a “weighing machine” in the long run, but in the short term it is a “voting machine”.

巴菲特敦促他们基于长期(而不是某一年的)表现作出评判,反映了投资者本杰明格雷厄姆(Benjamin Graham)的观点:长远而言股市也许是“称重机”,但在短期内它是“投票机”。

But in 2015, the market has voted negatively on Berkshire’s prospects for weathering the decline in commodities prices, according to Jim Shanahan, analyst at Edward Jones.

但是,据爱德华琼斯(Edward Jones)分析师吉姆餠纳汉(Jim Shanahan)表示,2015年期间,市场对伯克希尔驾驭大宗商品价格下降的前景投下了不信任票。

Although Berkshire has no oil and gas subsidiaries, its railway business transports oil, coal and agricultural products, and its manufacturing arm sells products to the shrinking oil industry. “They are impacted by the weak resources sector and commodity prices in general,” said Mr Shanahan.

尽管伯克希尔没有油气业务子公司,但其铁路业务部门运输石油、煤炭和农产品,其制造部门向不断缩水的石油行业销售产品。“它们受到资源行业不景气以及大宗商品价格普遍低迷的影响,”沙纳汉表示。

Berkshire has also been hit by big declines in two of its largest stock market investments: American Express, down 25 per cent this year, and IBM, down 13 per cent.

伯克希尔公司还受到两大重仓股大幅下跌的打击:美国运通(American Express)今年下跌25%,而IBM今年下跌13%。

But net earnings rose 18 per cent to $18.6bn in the first nine months of the year, and book value was up 3.3 per cent.

但伯克希尔今年前9个月净利润增长18%,至186亿美元,账面价值增长3.3%。

The fall in Berkshire shares comes against a 3 per cent return from the S&P 500, including dividends. It is only the 11th negative year since Mr Buffett took control in 1965, and the worst underperformance relative to the S&P 500 since 2009.

伯克希尔股价下跌之际,标准普尔500指数(S&P 500)今年实现3%的回报率(包括股息)。这是自1965年巴菲特掌舵以来第11个股价下跌的年份,也是自2009年以来相对于标普500表现最糟糕的一年。