Asset-backed securities still suffer an image hangover in the west from the days of the 2008 financial crisis. But China’s issuance of the financial products is soaring this year as Beijing places a big bet on securitisation as a salve for its huge credit risks. Though only a few years old, the Chinese debt securitisation market — in which pools of debt like mortgages, auto loans and credit-card loans are repackaged and sold to investors — is growing like topsy. Issuance of securitised assets rose 61 per cent in the first half of this year and could climb to $170bn for the full year, according to research by Bank of America Merrill Lynch.

受2008年金融危机影响,资产支持证券(ABS)在西方仍不受待见。但今年以来,此类金融产品在中国的发行量大幅飙升——北京方面正大举押注于证券化,把它作为缓解国内巨大信贷风险的一个途径。尽管形成仅几年时间,中国的债务证券化市场——抵押贷款、汽车贷款、信用卡贷款等债务池被重新打包并出售给投资者——正如脱缰野马般增长。美银美林(Bank of America Merrill Lynch)的研究显示,今年上半年中国证券化资产的发行量同比增加61%,全年将攀升至1700亿美元。

But are foreign investors ready to dive in? The answer appears to be a qualified yes. Given memories of how the US collateralised debt obligation (CDOs) market imploded 10 years ago, it is not surprising that foreign investors are cautious and generally avoid local issuers.

但外国投资者准备好进入中国这个市场了吗?答案似乎不是百分百的肯定。鉴于人们对美国债务抵押债券(CDO)市场10年前的崩盘仍记忆犹新,外国投资者对本地发行方持谨慎态度并且大体上敬而远之也就不奇怪了。

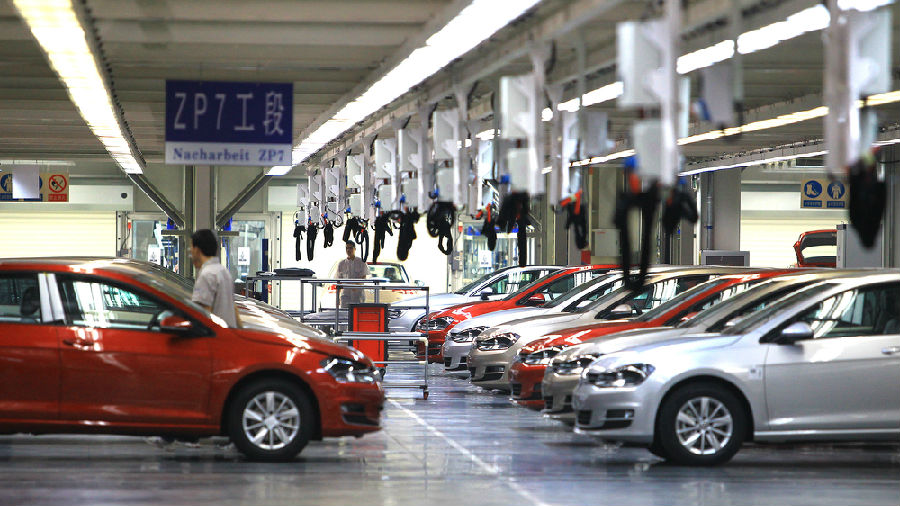

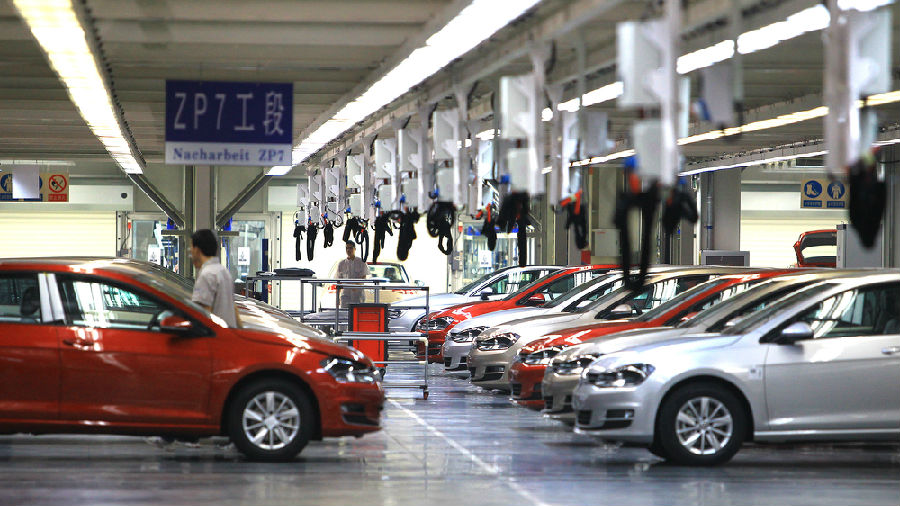

Nevertheless, car loan asset-backed securities issued by well-known international companies such as Volkswagen, Ford Motor and others are proving popular, analysts said. “Right now in asset-based finance in China, the area that foreign bond investors want to look at is foreign car manufacturers doing financing for auto loans,” said Alexander Batchvarov, managing director at BofA in London. “Currently this is giving a 5 to 8 per cent yield in renminbi. This is not a yield you can get anywhere in European investment grade bonds.”

不过,分析师表示,大众汽车(Volkswagen)、福特汽车(Ford Motor)等国际知名企业发行的汽车贷款资产支持证券(车贷ABS)被证明很受欢迎。“目前,在中国以资产为基础的金融产品领域,外国债券投资者感兴趣的,是外国汽车制造商为汽车贷款所做的融资,”美银美林驻伦敦董事总经理亚历山大?巴切瓦洛夫(Alexander Batchvarov)表示,“目前,其带来的人民币收益率为5%至8%。你购买欧洲哪一种投资级债券都得不到这样的收益。”

Effectively, investors are putting their trust in the reputation of the US and European carmakers to ensure that due diligence on loan quality is being observed and transparency standards upheld. So far, while the Chinese economy continues to grow strongly, the rates of delinquency on such asset-backed securities are low, analysts said. Liquidity levels have also been helped by strong issuance. Total auto asset-backed securities issued in the first half of the year hit Rmb60bn, according to Standard & Poor’s.

实际上,投资者相信以美欧汽车制造商的信誉,应该能确保有关贷款质量的尽职调查以及透明度标准会得到履行。分析师说,到目前为止,在中国经济继续保持强劲增长之际,此类资产支持证券的违约率很低。强劲的发行势头也有助于提升流动性水平。标准普尔(S&P)的数据显示,今年上半年发行的汽车资产支持证券总额达到600亿元人民币。

The Chinese lionise people who are “first to eat the crab” — suggesting outsize rewards for those who take on challenges. At the moment, those rewards are going to investors in carmakers’ ABS. But if China’s economy was to suddenly cool — especially if car sales slowed sharply — investors could find that the crab starts to nip them.

中国人推崇“第一个吃螃蟹的人”,因此那些接受挑战的人会获得特别大的回报。当前,那些投资汽车制造商发行的资产支持证券的人就有望得到这样的回报。但如果中国经济突然降温——尤其是如果汽车销量大幅放缓——投资者可能会发现螃蟹开始夹自己的手了。